Private Capital Industry Insight: Activity in and Around Calgary

November 16, 2025

Calgary skyline | Image courtesy of David Vincent Villavicencio

Overview of the Private Equity Industry in Alberta

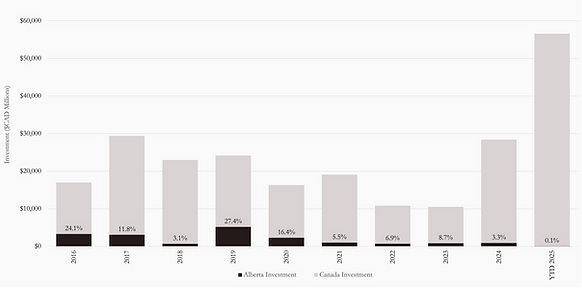

Canada is experiencing the largest inflow of private equity investment in its history. For the first nine months of 2025, Canada saw $56 billion in private equity investment. Over the same period, Alberta captured $74 million or just 0.1% of that investment. In the last decade, Alberta's private equity investment volume has been volatile, fluctuating between years of high and low transaction activity. For instance, in 2019, ONEX took WestJet private in a $5 billion deal, driving the year-end investment volume to $5.2 billion. The following year, investment fell sharply to $2.3 billion.

Looking ahead, steady oil and gas prices could strengthen Alberta’s private equity landscape. With much of the province’s private equity activity centred around energy companies, stable commodity prices reduce volatility and create a more predictable environment for investment, increasing firms’ risk tolerance. Additionally, as Alberta experiences increased investment in the venture capital space, it may begin to see an inflow of private equity investment, as many businesses are maturing into later-stage cash-flow-generating businesses.

Exhibit 1.1: Number of private equity deals and dollar investment in Alberta from 2016 to YTD 2025

Note: In 2019, WestJet was taken private in a $5B transaction, which significantly inflated the figures for that year.

Note: YTD 2025 Includes only concluded deals, not announced transactions. The $400M STEP Energy deal is not included.

Source: Canadian Venture Capital & Private Equity Association (CVCA)

Exhibit 1.2: Private equity investment in Alberta as a percentage of total PE investment in Canada

Note: Y-axis shows absolute values. Percentages on the bars are calculated relative to the total and are shown for proportional context; the visual heights reflect numeric values, not percentages.

Source: Canadian Venture Capital & Private Equity Association (CVCA)

Recent Private Equity Deal Flow & Fund Activity

Overview:

-

Waterous Energy Fund raises a new fund, loses a bid for MEG Energy, and acquires new shares in Greenfire Resources

-

STEP Energy acquired by Arc Financial

-

Longbow Capital closes its second energy transition fund

Waterous Energy Fund Raises New Fund to Shake Up and Consolidate Alberta’s Energy Sector

On March 31, 2025, Calgary-based Waterous Energy Fund (WEF) closed its third private equity fund, raising $1.4 billion. Founded by former Scotiabank investment banker Adam Waterous, WEF is a private equity firm focused on oil and gas acquisitions and consolidation plays. Led by a team of Scotiabank Capital Markets and KKR alumni, WEF first made headlines in 2020 with its consolidation of Cona Resources and Strath Resources to form Strathcona Resources. In 2023, WEF took Strathcona public at an $8.6 billion valuation. WEF may be trying to unwind its position in Strathcona, following a recent disposition of 5.3% of common shares.

Recently, Strathcona attempted to acquire MEG Energy in a cash-and-stock bid. MEG’s board immediately rejected the offer, compelling WEF to engage shareholders directly, which the board advised shareholders to reject. On November 6th, MEG shareholders approved an acquisition by Cenovus Energy, putting an end to the lengthy bidding process. WEF has used a majority of its third fund in acquiring shares of oil and gas company Greenfire Resources. Throughout 2025, WEF has taken an activist role in Greenfire, primarily through driving management changes. On November 12th, WEF acquired an additional 12.4% of Greenfire, increasing its total holdings to 68.3% of the company. The industry will continue to see more consolidation of the energy sector as WEF raises new funds.

STEP Energy Services Ltd. Agrees to be Acquired by Arc Financial

On October 17, 2025, oilfield services company STEP Energy Services entered into an agreement with private equity firm Arc Financial to be acquired in an all-cash deal at $5.50 a share, valuing the company at nearly $400 million. Arc funds owned 55% of the company and made a formal offer to acquire the whole company on September 25th. The acquisition price is a 29% premium above the unaffected share price.

Exhibit 2: STEP Energy share price on the date of the announcement of a take private by Arc Financial

Source: Bloomberg

Longbow Capital Closes Second Energy Transition Fund

On September 3, 2025, Longbow Capital, a Calgary-based private equity firm, closed its second energy transition fund at $365 million. Prominent LPs of the fund include the Business Development Bank of Canada (BDC), TD Bank, and Canada Growth Fund. The fund will direct investments towards companies with a focus on technologies and services that lower carbon emissions.

Overview of the Venture Capital Industry in Alberta

Alberta has seen strong growth in venture capital investment, primarily due to government involvement in the space. The Alberta Enterprise Corporation (AEC) plays a significant role in venture capital investment in the province, investing in startups on the condition that they have a local presence. Events in the city of Calgary, such as Innovation Week, which took place on November 3rd, and dedicated startup spaces such as Platform Calgary, have fuelled growth in the province.

Post-Covid, Alberta has been capturing a growing percentage of venture capital investment in Canada. For the first nine months of 2025, Alberta saw $433 million in venture capital investment, equating to 8.8% of total investment in the country. As Alberta experiences a growing technology scene in the financial and energy transition sectors, the industry is expected to see substantial growth.

Exhibit 3.1: Number of venture capital deals and dollar investment in Alberta from 2016 to YTD 2025

Note: YTD 2025 Includes only concluded deals, not announced transactions.

Source: Canadian Venture Capital & Private Equity Association (CVCA)

Exhibit 3.2: Venture capital investment in Alberta as a percentage of total VC investment in Canada

Note: Y-axis shows absolute values. Percentages on the bars are calculated relative to the total and are shown for proportional context; the visual heights reflect numeric values, not percentages.

Source: Canadian Venture Capital & Private Equity Association (CVCA)

Venture Capital Highlight: TDK Ventures Invests in Rodatherm Energy

On September 15, 2025, San Jose based TDK Ventures announced an investment in Rodatherm Energy Corporation, a geothermal power-generation company focused on the Great Basin region in the western United States. TDK Ventures is making the investment in Rodatherm's $38 million Series A funding round. Rodatherm is based in Salt Lake City, Utah but has a large operational presence in Calgary.

Private Credit Highlight: KV Capital – Calgary Rental Development

On September 17, 2025, KV Capital announced it had provided C$82.4 million in construction financing for “Arthur,” a 254-unit purpose-built rental project in Calgary’s Currie neighbourhood.

For any questions or inquiries, please reach out to our team at info@bissettprivatecapital.com